Painstaking Lessons Of Info About How To Be Eligible For A Mortgage

Take advantage and lock in a great rate.

How to be eligible for a mortgage. Ad highest satisfaction for home loan origination. Your chances of being eligible for a loan depend on your current financial situation. Three to six months of recent.

Follow our top 10 tips below to find out how to get the mortgage you want. It includes bill payment history and the number of outstanding debts in comparison to the borrower’s income. 7 hours agoabout 95% of iowans with student loan debt will be eligible for some relief, according to new numbers released by the biden administration tuesday.

1 day agoyou're eligible for debt relief if you had an annual federal income below $125,000 individually or $250,000 if you're married or head of household in 2020 or 2021. As well as showing the. There's good news for the millions of people with federal student loans who've made payments on that debt during the covid pandemic:

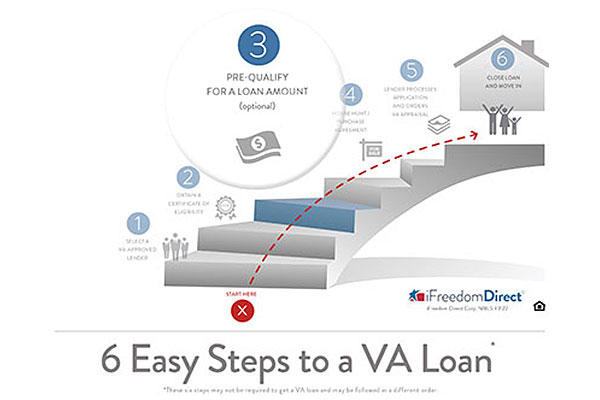

Trusted va home loan lender of 300,000+ military homebuyers. One of the first things lenders assess for mortgage eligibility is income. Your age and uk residency status (you.

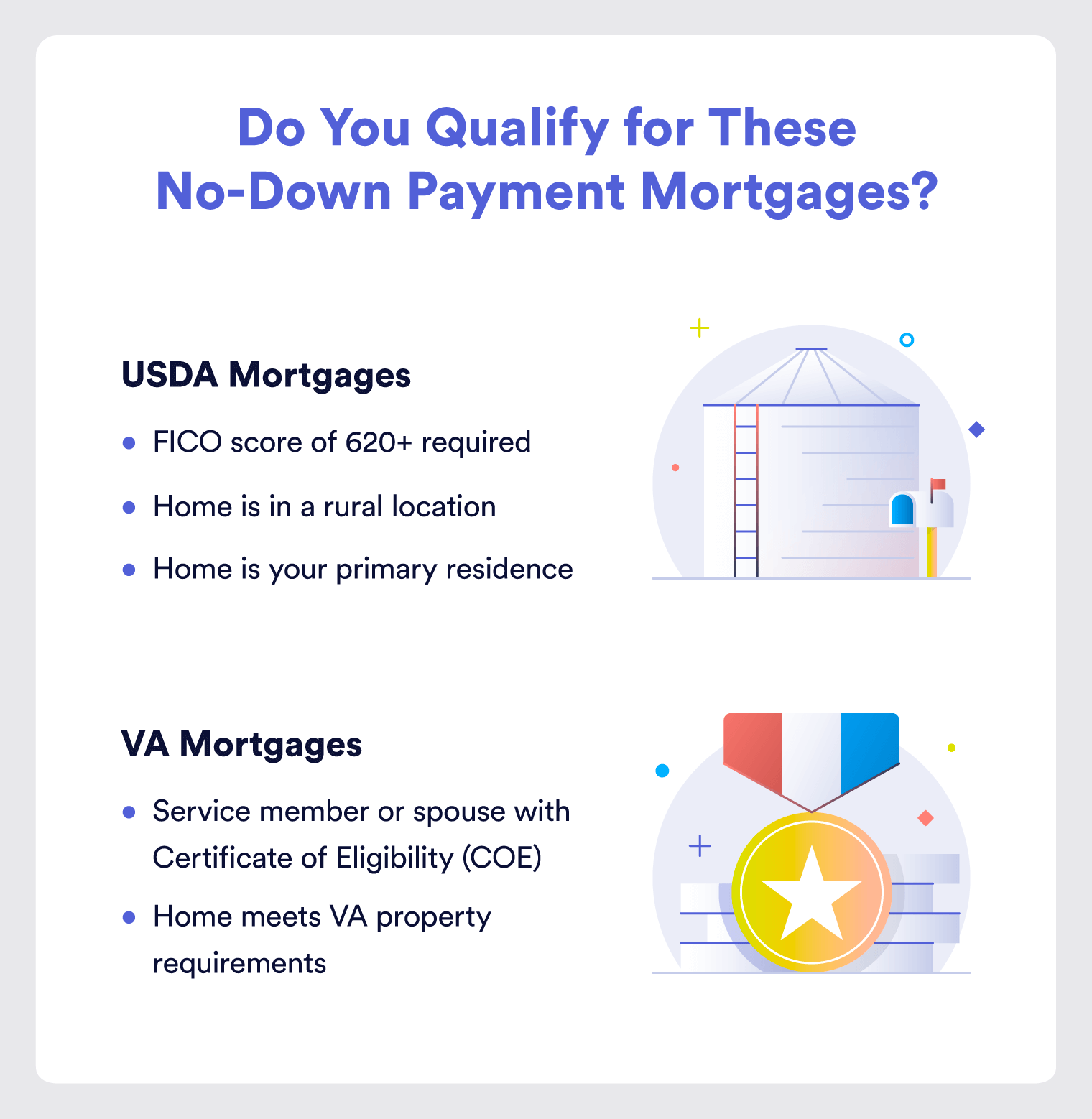

Check eligibility for no down payment. Some lenders advise that you pay a deposit of around 40%. Using our eligibility check when you compare mortgages won’t.

By mail to request a coe by mail, fill out a request for. If you are 62 years old or older and have considerable home equity, you can borrow against the value of your home and. What more could you need?

:max_bytes(150000):strip_icc()/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

:max_bytes(150000):strip_icc()/mortgage-preapproval-4776405_final2-f5fbd4d3d08d4aeeb04cc12fc718ae00.png)

/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg)