Build A Info About How To Become A Enrolled Agent

Schedule and pass the ea licensing exam.

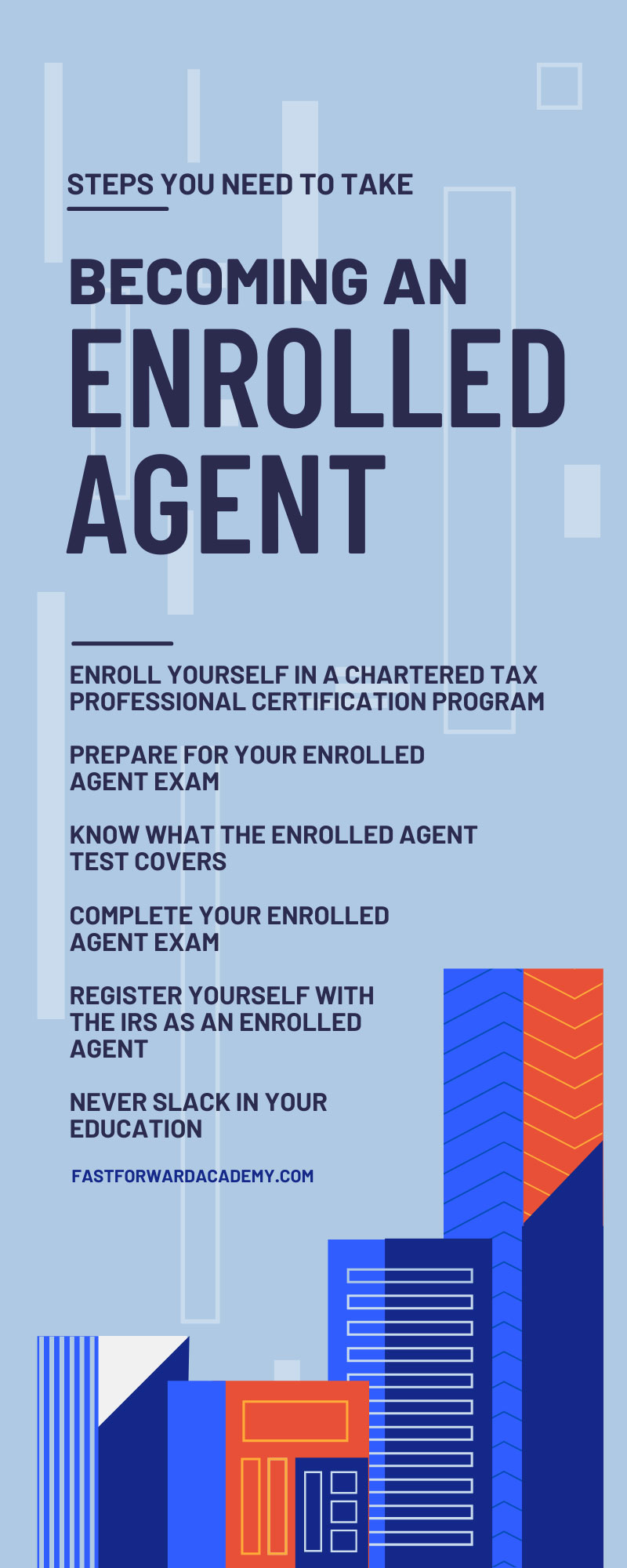

How to become a enrolled agent. The federal government requires passing a comprehensive examination or having 5 years work experience with the irs to become a licensed enrolled agent. Steps to become an enrolled agent there are three routes to attaining, or maintaining, your ea licensure: You can take and pass the online exam, or you can work for the irs.

You will need to achieve a passing score on all three parts of the exam to become an enrolled agent. Past service or technical service with the irs is considered acceptable. A minimum of 16 hours must be earned per year, two of which must be on ethics.

The latter includes tax compliance, ensuring the candidate has no. The irs issues ptins on a. Enrolled agents, also known as e.a.s, are tax professionals with.

The internal revenue service describes an enrolled agent as the following: Treasury department has appointed to represent taxpayers before the irs. To become an enrolled agent, the candidate must pass a criminal background check along with a suitability check.

If you choose to go this. This is part of the hours of continuing education. Enrolled agents have demonstrated competence in tax matters, allowing them to represent taxpayers before the internal revenue service.

Another way to become an enrolled agent is by having irs experience. Renew your status as an enrolled agent every three years obtain continuing education renew your ptin annually. Testing, experience, or fees and cpe.