Unique Info About How To Choose A Mortgage Company

![Top 10 Reasons To Choose A Mortgage Broker [Infographic]](https://www.investopedia.com/thmb/XPdg0Aa8cYFx_WUKs_0qmooSYH8=/1200x800/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)

Checking customer ratings and reviews are a good starting point for anyone trying to find the perfect boston mortgage company.

How to choose a mortgage company. Three essentials for choosing the best mortgage company. However, other costs, such as. When you’re ready to get a mortgage, you’ve got a lot of options.

Mortgage companies can qualify your budget. Ad looking for a mortgage? Verify that the company has been around a.

Compare the best mortgage lender that suits you & enjoy our exclusive rates! Comparing the rates offered by these lenders can help. A significant question people face during the mortgage process is determining which mortgage company to choose.

Ad fha, va, conventional, harp, and jumbo mortgages available. A mortgage insurance premium (mip) is required for any mortgages, including reversed mortgages, which the federal housing administration insures. The type of lender you choose will determine the loan offers available to.

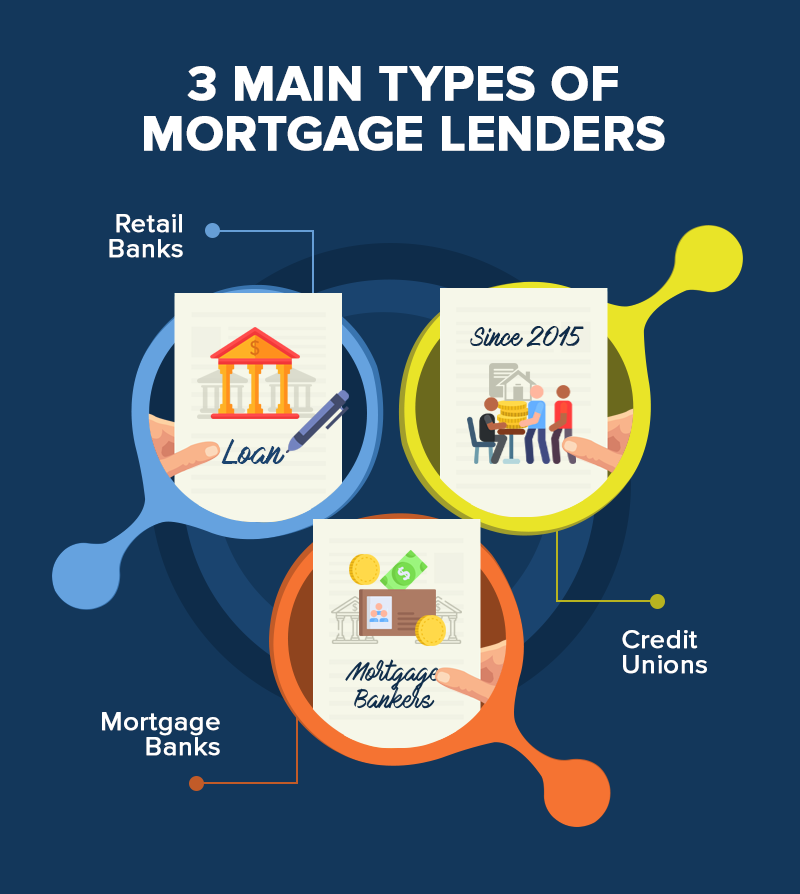

3) customer ratings and reviews. More options to choose mortgage lending consultant: Understand the different types of mortgage lenders.

The first title insurance company, the law property assurance and trust society, was formed in pennsylvania in 1853. Loan officers and mortgage brokers earn money from the transactions they. The internet has a wealth of resources that can help you make an informed choice when choosing a mortgage company.

:max_bytes(150000):strip_icc()/dotdash-090915-mortgage-broker-vs-direct-lenders-which-best-Final-c7e52f06ff4f41bca0744429ee1838e3.jpg)

/dotdash-090915-mortgage-broker-vs-direct-lenders-which-best-Final-c7e52f06ff4f41bca0744429ee1838e3.jpg)

![Top 10 Reasons To Choose A Mortgage Broker [Infographic]](https://infographicjournal.com/wp-content/uploads/2021/03/How-To-Choose-A-Mortgage-Broker.png)

/dotdash-090915-mortgage-broker-vs-direct-lenders-which-best-Final-c7e52f06ff4f41bca0744429ee1838e3.jpg)

/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)